Regional Growth Outlook Downgraded Slightly

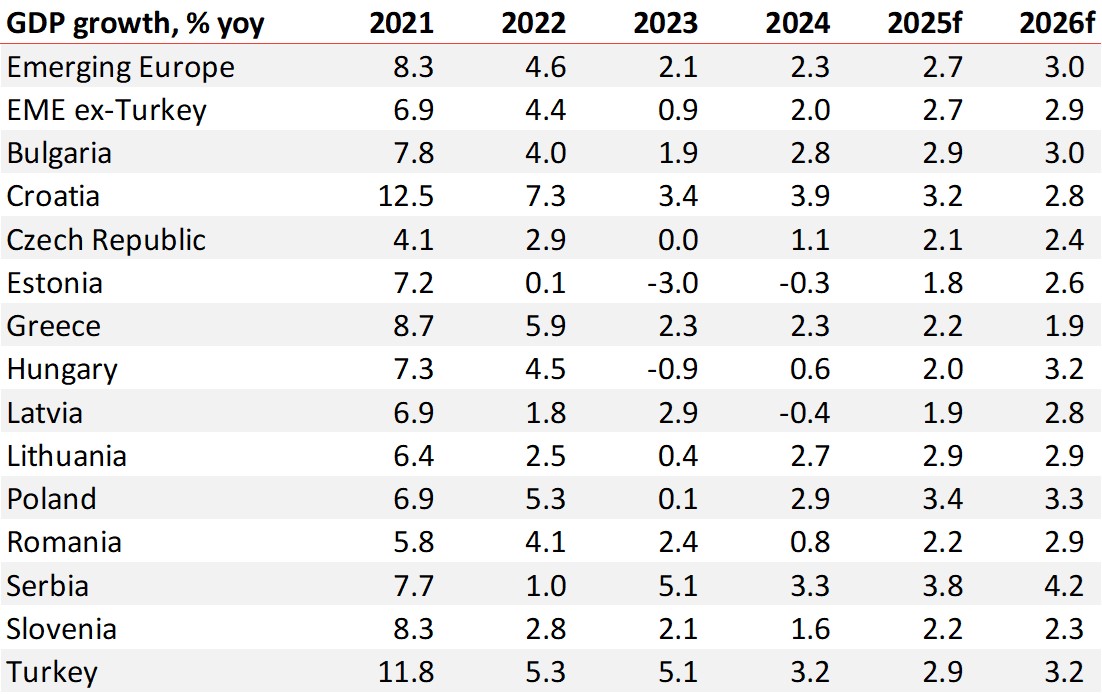

2025 economic outlook in the Emerging Europe region has seen ca. 0.3pp downgrade since the start of the year. Average GDP growth is currently expected at 2.7%, fuelled by rising investments and steady consumer spending. This represents a 0.7pp acceleration compared to 2024, excluding Turkey, where the restrictive monetary policy is taking its toll and growth is expected to slow below 3%.

Drivers of Growth: Investments and Consumption

We expect household spending to keep growing, albeit at a slightly slower pace, and private consumption to continue to positively contribute to the 2025 growth. The acceleration in economic development should come from higher investment activity next year driven by the restart of projects financed from the new EU budgeting period.

External Risks: US Tariffs Weigh on Optimism

After somewhat underwhelming performance in 2024, this year was expected to bring further economic acceleration in the region, but that positive outlook has now been dampened by the risks related to US tariffs. It is estimated that the average combined direct and indirect impact of 10% tariffs on Emerging Europe growth could be up to -0.3pp to -0.6pp cumulatively over 2025-26.

We expect spending to keep growing, albeit at a slightly slower pace in several Emerging Europe countries. Private consumption will continue to positively contribute to the 2025 growth. The acceleration in economic development should come from higher investment activity next year. This acceleration should be driven by the restart of projects financed from the new budgeting period (MFF 2012-27).

Country Spotlights

Hungary and Romania: Subdued Growth, High Inflation

Hungary and Romania were already on track for subdued growth, with 2025 GDP forecasts at or below 2% even before the trade shocks. By contrast, Poland and the Czech Republic entered the year on a stronger footing, with early signs of continued recovery in Q1. At the same time, inflation remains elevated across the region, with Hungary and Romania – despite slower growth – seeing more pronounced inflation pressures than their faster-growing peers.

This asymmetric inflation-growth profile significantly narrows the policy space for Emerging Europe central banks, especially in the event of further global growth deterioration. So far, monetary authorities in the region have refrained from making decisive moves, and their delayed reaction compared to global central banks is understandable.

Hungary and Romania are likely to remain cautious. Despite a slight easing in Hungarian inflation in March, the National Bank of Hungary (NBH) is unlikely to resume rate cuts in the near term. The NBH currently estimates the tariffs could shave 0.5–0.6pp off GDP this year, but unless there is a meaningful escalation in trade tensions or a sharp deterioration in risk sentiment, policy will likely stay on hold. The forint continues to act as a constraint on easing, functioning as a stabilizing mechanism in case of capital outflows.

Estimates of the potential impact of tariffs on Romanian economy are slightly lower compared to their main regional peers, at -0.3-0.5 cumulatively in 2025-26. Internally, fiscal policy continues to remain the key concern without any consolidation progress being made so far this year. As such, we expect the central bank policymakers to continue to adopt a wait-and-see approach, keeping rates on hold at 6.5% in the near-term.

Poland and Czech Republic: Diverging Monetary Paths

The picture is more dynamic in Poland and Czechia. In April, the Polish central bank signaled a clear dovish pivot. A 50bps rate cut is now expected in May, with a total of 100bps of easing likely this year, and potentially more if currency conditions are favorable. The Polish Ministry of Finance anticipates a 0.4pp hit to GDP from the tariffs, further reinforcing the case for stimulus.

Czechia may be the most closely watched. The Czech National Bank (CNB), already the most active in terms of easing in the region, was nearing the end of its easing cycle before the tariff news broke. The Finance Ministry sees a GDP hit of 0.6–0.7pp from the tariffs. While this may not justify a deeper dive below the 3.25–3.50% neutral rate range just yet, the CNB’s openness to further cuts has likely increased. Still, elevated headline inflation and solid domestic fundamentals are likely to preserve a hawkish bias, unless trade disruptions escalate further.

Greece: Stable Growth and Softening Inflation

Greece’s economic outlook remains stable at above 2% driven by domestic demand. Private consumption is underpinned by rising real wages (recent wage hikes and lower inflation) and strong tourism revenues, while investment is picking up thanks to EU funds. Inflation in Greece is moderating and forecast to decline further to 2.1% this year as underlying price pressures are softening – wage growth is moderate and global inflation has eased. Regarding the potential trade war impact, a recent study by the National Bank of Greece estimated that a blanket 10% tariff increase on all EU exports to the US could reduce total Greek exports by approximately 1.7% in real terms and lower Greece’s GDP by 0.4% cumulatively through the end of 2026.

Turkey: Tight Policy Amid Inflation and External Headwinds

Turkey’s economy slowed in 2024 after the post-earthquake rebound, with GDP growth coming down to 3.2%. Official forecasts see growth in 2025 around 2.7–3.0%. Strong domestic demand and investment (especially rebuilding after 2023 earthquakes) continue to support growth, but prospects are dampened by high borrowing costs and a weak export outlook. Export growth is constrained by slower global demand (especially from Europe and the Middle East) and by a strong lira in real terms. Turkey remains an outlier in the region with very high inflation. CPI is projected to stay above 30% through 2025. The disinflation that began in May 2024 (from 75% level) continues, but sticky food and administered-price increases together with recent FX volatility mean inflation will remain high by international standards. Monetary policy is likely to remain very tight (real rates high) until inflation clearly falls; any easing in 2025 will be conditional on continued disinflation and currency stability. Trade policy headwinds for Turkey will be indirect, denting global growth and tighten global financial conditions, which may in turn slow Turkish exports and tourism. However, recent analyses note that US tariffs on Chinese/EU goods could have mixed effects as Turkish manufacturers might pick up some displaced orders (e.g. textiles, auto parts), but any European slowdown and a stronger dollar could weaken Europe’s demand for Turkish exports. Dependent on how the trade war will finally play out, Turkey also holds the potential to establish itself as a strategic production location for Asian, especially Chinese companies looking to avoid high custom duties.