Emerging Europe: 2025 Economic Outlook and Investment Implications

Growth Outlook: Investment and Consumption Drive Recovery

2025 economic outlook in the Emerging Europe region is solid, with an average expected growth of around 3%, fuelled by rising investments, especially in Poland (+9% yoy) and steady consumer spending. The trough of investment activity related to the switch between financing periods of EU funds took place in 2024, in our view, and we should see a pick-up in investment growth going forward. Acceleration of investment growth is expected to be one of the main drivers behind the higher economic growth dynamics in 2025 in most regional countries. Private consumption has accelerated over the course of 2024, and next year we expect to see similar growth dynamics across the region. Households’ purchasing power has recovered and we expect spending to keep growing as long as inflation moderates further.

Monetary Easing to Support Growth

Importantly, macroeconomic improvement should be supported by rate reductions across the region (up to 150bps in Poland, up to 100bps in the Czech Republic, up to 75bps in Hungary and up to 50bps in Romania) as well as the Eurozone (100bps or higher). In Turkey, assuming inflation will drop below 30% by year-end, we could expect policy rate drop to 30%, -17.5pp from the current level.

External Risks: Tariffs and Political Uncertainty

The external environment (change in the US political landscape, weakness of German economy) poses considerable downside risks for 2025 growth outlook, even though the negative impact of tariffs is already, to some extent, pencilled into consensus projections. Increased uncertainty regarding US policies may negatively affect market sentiment and eagerness to invest already, weakening the recovery impulse. It is likely that some re-stocking is already taking place now, before tariffs are introduced. However, the negative impact stemming from tariffs should be less pronounced in 2025, with more negative potential impact coming in 2026. Regardless, the direct impact from tariffs should be limited as in most regional countries the exports to US are at around 1-2% of GDP, while Slovakia, Hungary and Slovenia are the most exposed with at around 5% exposure.

Fiscal Consolidation: A Necessary Headwind

Fiscal consolidation is another growth-negative factor impacting the economic prospects of the region. Czechia, Romania and Slovakia are on track to lower the budget deficits in a most considerable manner with expected deficits in 2024 of 3%, 9% and 6% to GDP, respectively.

Market Implications: Equities Supported by Macro Backdrop

In terms of stock market outlook, we think that the region is well positioned to maintain positive momentum. The economic backdrop remains solid with growth outlook improving. Forward looking corporate earnings trajectory is positive and better than for the global benchmark. The two main region-affecting Trump presidency related promises, peace settlement in Ukraine and tariffs, are net positive for Emerging Europe equities. Higher tariffs are expected to be inflationary, thus potentially delaying further monetary easing. Although at the same time tariffs pose risks to growth, higher prevailing rate environment would be positive for regional banks which constitute the largest sectoral exposure in the region.

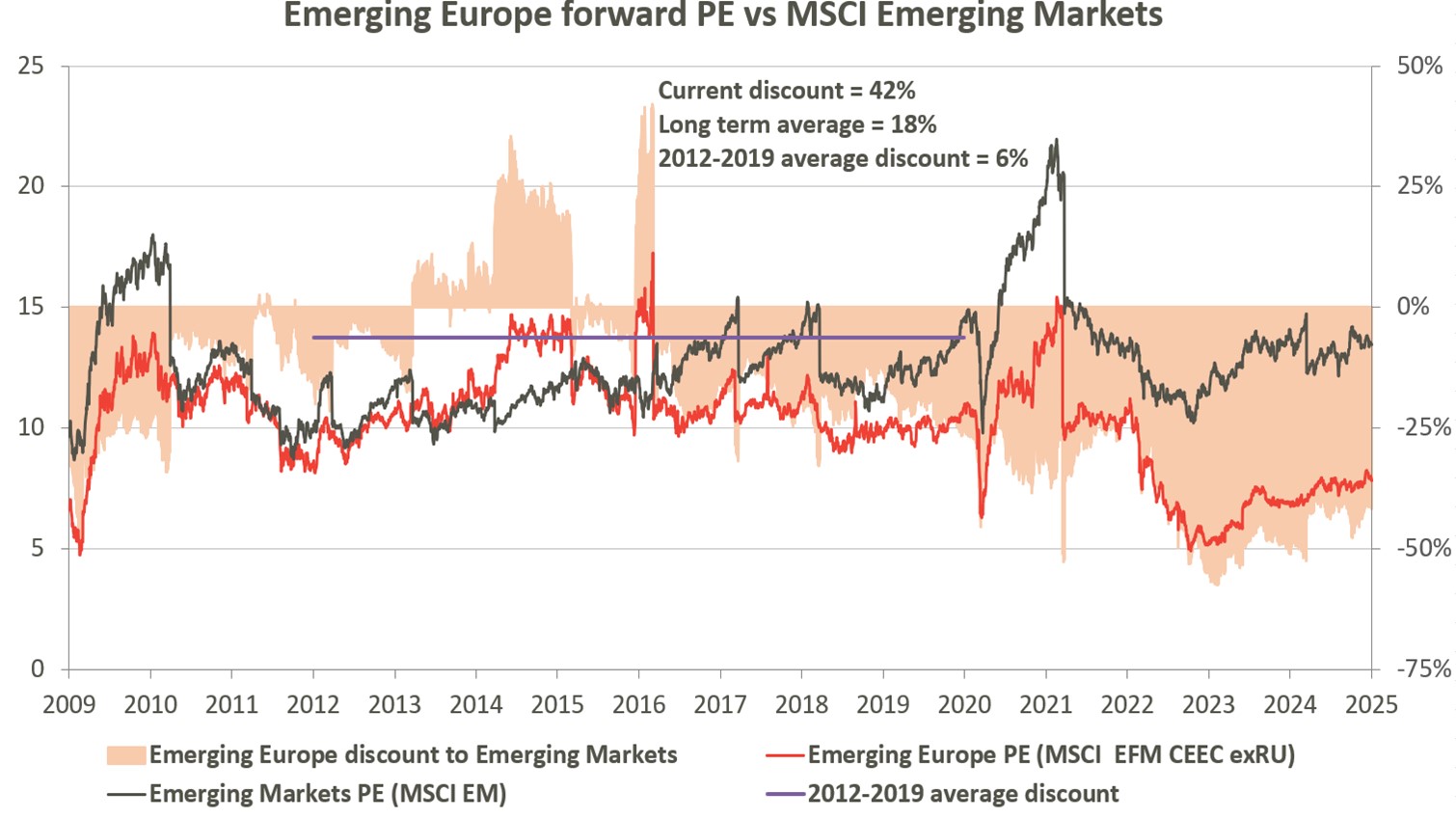

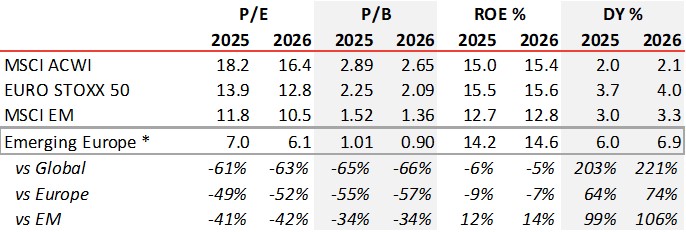

Emerging Europe region continues to trade at a significant discount to Europe, global emerging markets and MSCI ACWI. Long-term average discount of Emerging Europe to Emerging Markets stands at 18% while in 2012-2020 it stood at an extremely low level of 5%. We believe Emerging Europe’s fair discount to Emerging Markets should be at around 15% due to lower liquidity. Moreso, the valuations within the region continue to show tangible discounts to historical averages. We expect a solution to the Ukraine-Russia war, once it happens, to close the valuation gap significantly as investors who are today avoiding the region are expected to return.

* MSCI EFM EUROPE + CIS (E+C) ex Russia index

Corporate Earnings Outlook: Stability and Upside

Earnings growth for Emerging Europe region in 2025 is expected to be -5% yoy, following +15% and -6% in 2023-24, respectively. Last year oil & gas sector was a notable drag on benchmark’s earnings with a stabilization expected now in 2025. However, banks are foreseen to offset that improvement due to their high share in the index, high earnings base in 2024 and headwinds from declining rate environment. Leaving banking sector aside, the corporate earnings outlook is positive and further improving. Upward pressure on costs has flattened, although companies’ operating costs remain at a high level. Particularly in the case of higher real wages, rising savings rates prevent higher disposable incomes from supporting operating corporate margins through consumption. At least most regional companies have left their investment budgets unchanged and are therefore not calling future growth into question.

Long-Term Performance: Stronger than Global Peers

It is worth noting that since Covid pandemic the regional banking sector has each year outperformed consensus expectations and we see this as a possibility also in 2025 as most banks have and are continuing to reduce their sensitivity to rate cuts. Over the past 5 years (2019-24) benchmark level earnings CAGR in Emerging Europe has been 7.4%, significantly higher than in global emerging markets (MSCI EM 1.0%) and in Europe (MSCI Europe 5.8%). Earnings CAGR in US (S&P500) has been similar to our region (7.8%), which has helped to offset weak EM and Europe on global benchmark level (MSCI ACWI 6.2%).