Emerging Europe: Navigating a Fragile Economic Recovery

Manufacturing Slump Continues Amid Weak External Demand

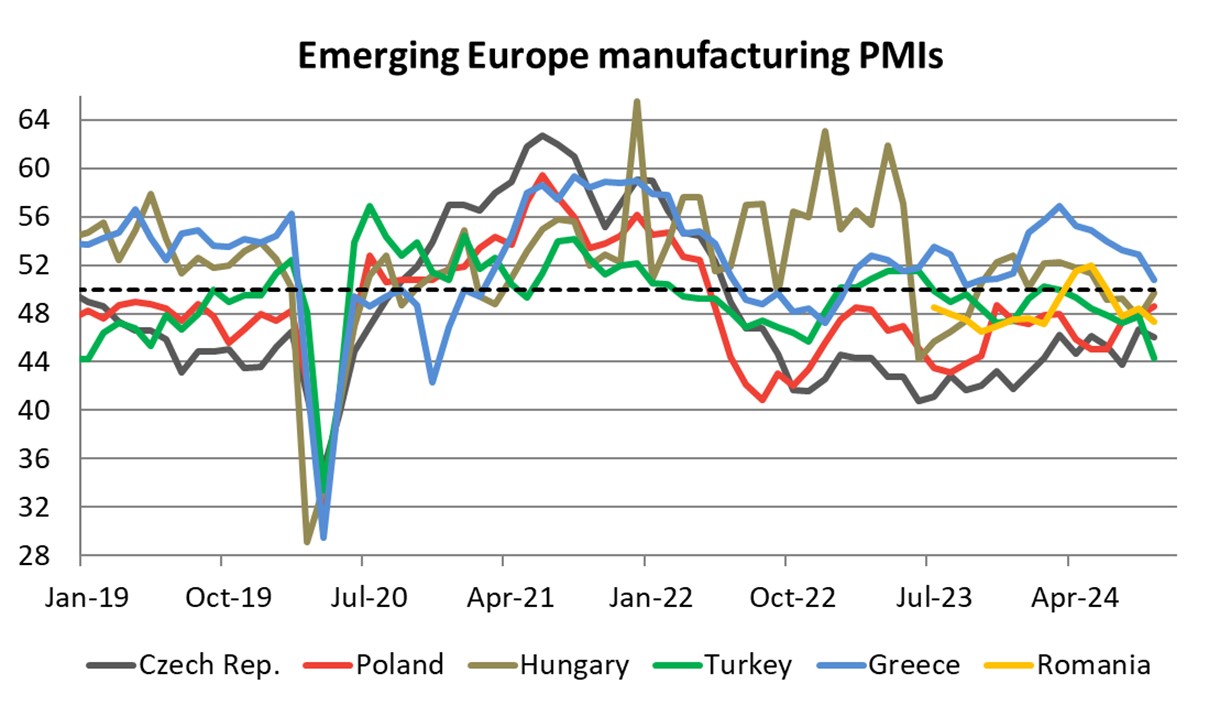

Emerging Europe leading indicators continue to move sideways. The manufacturing sector remains in the contraction zone as PMI indices continue to move below the no-change level of 50.0. External demand has remained weak and more importantly the German economy does not show any signs of recovery, translating into falling new orders. Greece continues to be the only country where PMI has stayed above the 50.0 level however, the sentiment has clearly softened over the past few months with September reading at 50.8. Turkey’s manufacturing PMI collapsed in September to 44.3 recording the sharpest slowdown in new orders since May 2020 indicating that high interest rates together with persistent inflation (52% in August) is eroding the purchasing power of local consumers. At the same time new export orders also moderated amid subdued demand in international markets.

Sentiment Indicators: Mixed Signals Across the Region

European Commission economic sentiment indicator (ESI) for Emerging Europe improved slightly in September for the second consecutive month. This led to a slight increase in the average ESI in 3Q24 compared to 2Q24 driven by better sentiment in Czechia, Greece, and Poland, while economic sentiment declined in other countries.

Additionally, consumer confidence saw a modest deterioration in September. Overall, the market sentiment suggests a slow recovery in the second half of the year.

Source: S&P Global

Source: European Commission

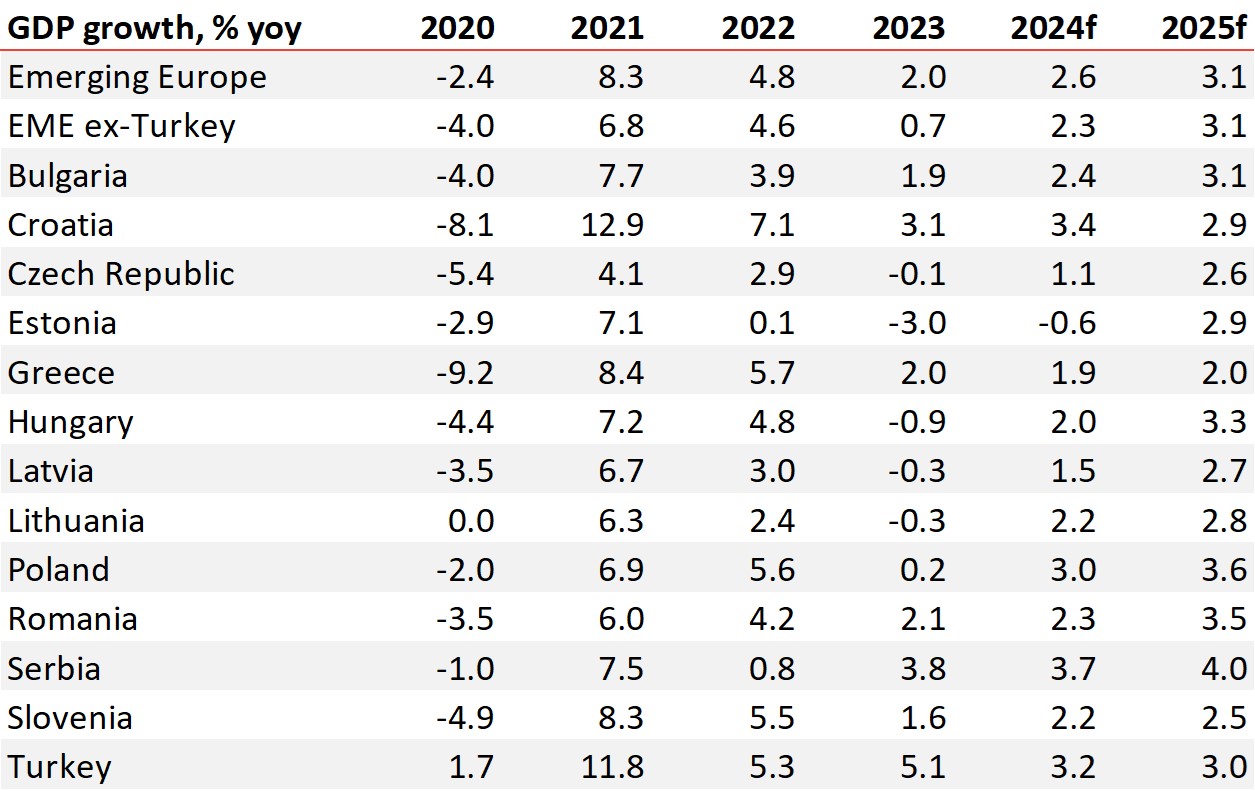

Growth Trends: Poland Leads the Way, Baltics Lag

Regional GDP growth ex-Turkey continued to accelerate in Q2, reaching 2.3% yoy compared to +1.5% in Q1. However, the performance across countries has remained mixed. Poland was the main contributor to the rebound as its annual economic growth jumped to 3.2% from 1.9%, while growth in Southeast Europe remained unchanged at 1.8% yoy and marginally slowed in the Baltics to 0.7% (Q1: +0.8%). Estonia is the only country in recession (-1.0% yoy).

In 2024 the regional economy ex-Turkey is expected to grow 2.3% compared to 0.7% in 2023. Fall in inflation, sharp rise in real wages and gradual pickup in private consumption, combined with selective interest rate cuts, are supporting the ongoing economic rebound. However, the recovery in consumer spending so far this year has been weaker than expected and has prompted downgrades in the growth outlook. At the same time weakness in manufacturing sector continues because of poor performance of Eurozone, especially the German economy. Capacity utilization levels are declining and have reached the lowest level in last decade apart from pandemic year 2020.

Source: LSEG

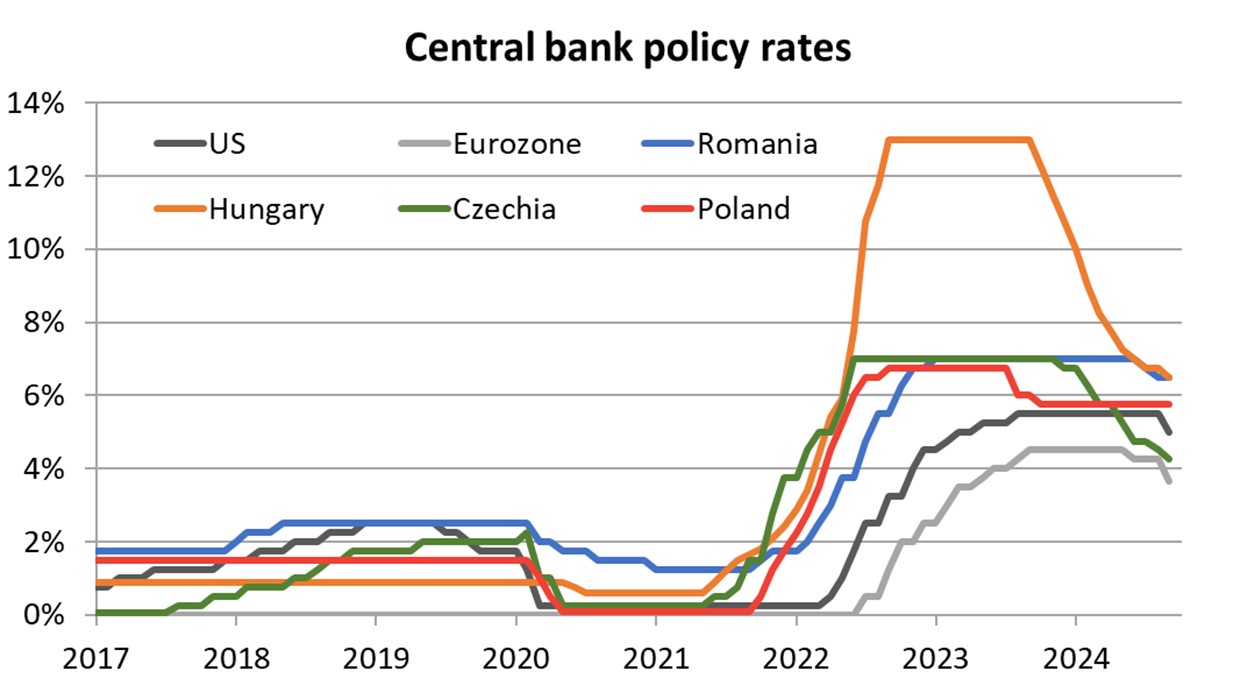

Inflation Outlook and Monetary Policy Stance

Monetary easing is expected to stall in Q4 as headline inflation should rise in the remainder of the year driven by statistical effects but as well by regulatory price adjustments. Central banks in the region will continue with monetary easing in 2025 as further inflation declines should allow for more rate cuts across the region. Main downside risks to growth (Germany’s weakness, fiscal consolidation) are likely to outweigh upside risks from tax increases within fiscal consolidation plans and pending adjustment of energy prices in select countries.

Source: Respective central banks

Fiscal Consolidation: A Key Risk for 2025

Looking further into 2025 an important risk to growth is related to fiscal consolidation. Several regional countries have been put under the Excessive Deficit Procedure (EDP) and fiscal tightening is in 2025 plans for most, except for Poland and possibly Hungary. This amplifies the risk that 2025 growth shall be weaker than the currently expected 3.1%