2025 in Emerging Europe in rear-view mirror

Emerging European equity markets delivered a standout performance in 2025, surging 34.6% in € and outpacing all other major regional benchmarks. What made the year distinctive was not just strong returns, but the fact that many long-standing structural headwinds began or continued to reverse simultaneously, forcing investors to reassess risk premia that had been embedded in the region for the past couple of years.

Lowered perceived risk of war escalation

The geopolitical backdrop remained complex, but crucially it became less one-directional. The ongoing Russia-Ukraine war continued to define regional risk perceptions, yet the return of Donald Trump to the United States presidency altered expectations in a positive way. The new administration signalled a clear desire to de-escalate the conflict, reducing direct US military support and actively pushing for negotiations. High-level diplomacy intensified through the year, including direct US-Russia engagement. While no comprehensive peace agreement has been reached, the growing probability of a ceasefire or negotiated settlement has reduced tail-risk scenarios for Emerging Europe. It has lowered the perceived risk of escalation beyond Ukraine’s borders and reopened the medium-term narrative around Ukraine’s eventual reconstruction, where neighbouring economies, US and European industrial firms are likely to play a central role.

At the same time, the less predictable US security stance forced Europe to confront its own strategic vulnerabilities. Rather than undermining confidence, this has acted as a catalyst for a historic shift in fiscal policy. European governments committed to the largest increases in defence spending seen in decades, effectively turning security into a new growth driver. This was not confined to Western Europe. Emerging European countries, particularly Poland, have accelerated military spending to levels exceeding 4% of GDP, stimulating domestic industry, infrastructure investment, and high-value manufacturing. The defence buildup is functioning as a quasi-industrial policy, generating spillovers into engineering, technology, logistics, and R&D. In macro terms, Europe’s assumption of greater responsibility for its own security is translating into a durable fiscal impulse.

Emerging Europe grows at 3% while Germany and France stagnate

Beyond geopolitics, the macro backdrop improved in parallel and with greater consistency. Inflation, the binding constraint since 2022, continued to fall across the region, giving central banks room to press ahead with policy easing. The signal to markets was unambiguous: the inflation shock had been absorbed, and the cost of capital was moving decisively lower. Growth momentum continued to strengthen over the course of 2025. Emerging Europe outperformed Western Europe by a wide margin, underpinned by robust domestic demand, sustained EU-funded investment, and an acceleration in credit growth.

Regional GDP growth is on track to approach 3%, a stark contrast to near-stagnation in Germany and France. This divergence was reinforced by large-scale fiscal initiatives, particularly at the EU level through defence and infrastructure spending, while southern Emerging European economies added further momentum via booming tourism and the revival of bank lending.

Capital rotation from the US to emerging markets

External conditions, driven in large part by the change in the US administration, reinforced these tailwinds. A sharply weaker US dollar lifted returns on non-US assets and accelerated the rebalancing away from an expensive and increasingly crowded US equity market. With US valuations stretched at the start of 2025, capital rotated decisively toward international and emerging markets. Fund flow data confirmed this shift, with sustained inflows into EMEA-focused equity funds and even politically sensitive markets drawing fresh capital. Crucially, this seems not merely a short-term tactical positioning. After years of structural underweighting, 2025 marked the start of a more durable institutional reallocation toward emerging markets.

Valuations were the final element behind Emerging Europe’s stock market outperformance. The region entered 2025 priced still at deep discount versus global peers, and below their own historical norms. With expectations compressed to very low levels, even modest improvements in geopolitical outlook translated into significant valuation gains. As perceived risks declined and economic momentum strengthened, multiple expansion became a central driver of returns.

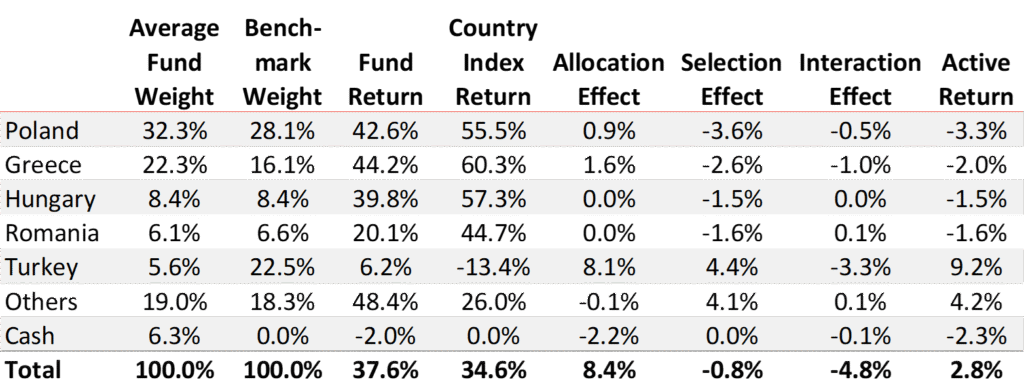

Avaron outperforms the market

During this extraordinarily strong market environment Avaron Emerging Europe Fund managed to outperform the benchmark, delivering 37.6% gross return (+35.5% net of fees). Although the portfolio is managed on a fully bottom-up basis, the attribution indicates that the dominant source of active return in 2025 was the allocation effect, emerging as a by-product of the investment process rather than from explicit top-down positioning. Stock selection naturally concentrated capital in companies domiciled in the strongest-performing markets, most notably Greece and Poland, resulting in positive allocation effects at the country level. However, in both countries, stock selection did not outperform the respective country indices, yet it was sufficiently strong to deliver returns materially above those implied by the benchmark. Poland accounted for a 13.8pp contribution to the annual return, with Greece adding a further 9.9pp.

Turkey was the primary source of positive active return. Despite the challenging market environment, bottom-up security selection there was effective and added value relative to the local index, while an organically lower exposure to the market generated a positive allocation effect. In combination, selection and allocation worked in the same direction, reinforcing portfolio level outperformance. However, Turkey’s contribution to the annual portfolio return was marginal, amounting to just +0.3pp.

The Others segment complemented Turkey in positive active return generation. Here, substantial positive impact was generated almost entirely through selection, driven by the strong performance of Slovenian holdings. This was largely independent of allocation effect and underscores the ability of our bottom-up process to uncover idiosyncratic opportunities in smaller and less represented markets. Slovenia was the third-largest contributor to annual portfolio return, adding 4pp.

On single-stock level Polish energy company Orlen was the best performer and largest return contributor in 2025. After being the top detractor with 0.9pp the year before, the stock went through a massive rally after unveiling a new strategy at the beginning of the year aimed at more efficient capital deployment and strong improvement in operational performance during the year. This led to significant re-rating of the stock from 2x 1YR FWD EV/EBITDA in the beginning of 2025 to 4x now. Following this, the position was reduced to below 2% of the Fund, down from a peak weighting of 7% during the year.

From a sector perspective, financials delivered the strongest performance in 2025, contributing 17.9pp to the annual return. This was driven largely by the strong performance of banks, with three banking positions ranking among the Fund’s largest individual contributors over the year. We maintained a positive stance on the sector despite an unfavorable rate cycle and the elevated earnings base of 2023-24, as we believed the market was underestimating the earnings power of banks on normalized profitability and overstating the negative impact of declining interest rates.

As the year progressed, operating conditions proved more supportive than anticipated. In Greece and Poland, solid macroeconomic fundamentals and improving confidence translated into better than expected volume growth, which helped to offset pressure on net interest margins as rates declined. Banks in Hungary and Romania continued to benefit from a still-restrictive monetary environment, with base rates at 6.5% supported by persistent inflation, sustaining high levels of interest income. Over the course of the year, banks in the portfolio re-rated from approximately 6.5x 1YR FWD P/E to around 9.0x. Despite this meaningful re-rating, we continue to see upside, as current valuations remain roughly 20% below our assessment of fair value.

The largest detractors can be grouped into two subsegments – recent additions and small caps. In the case of the former, entry timing proved somewhat unfortunate despite positions being built gradually. Small caps, meanwhile, lagged blue chips across the region. For example, Polish WIG index delivered a whopping 22.1pp better return last year compared small cap index sWIG80.

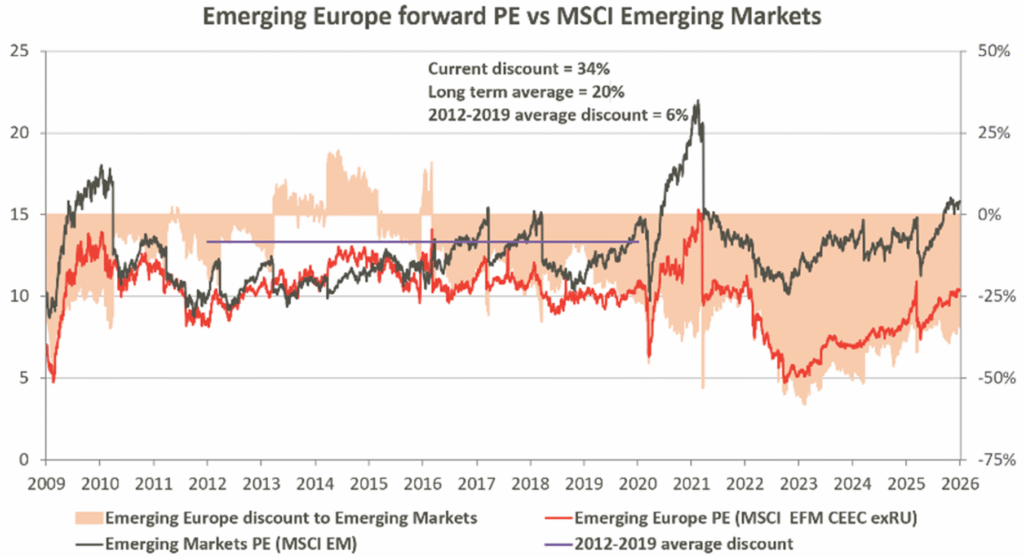

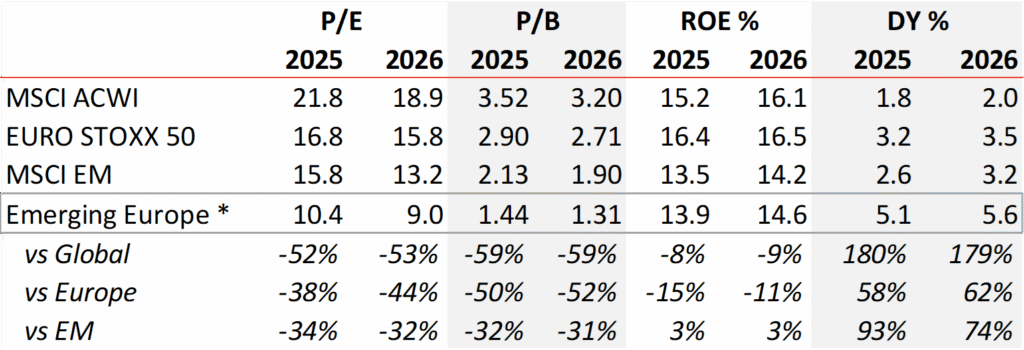

Emerging Europe has additional 30% re-rating potential

Despite exceptionally strong performance and further re-rating in 2025, Emerging Europe continues to trade at a meaningful discount to Europe, global emerging markets, and the MSCI ACWI. The current discount to Emerging Markets stands at approximately 34%, compared with a long-term average of around 20%. Historically, this discount has been considerably narrower, averaging roughly 6% during the 2012–2020 period. In our view, a fair discount for Emerging Europe relative to Emerging Markets should be at around 10%, primarily reflecting lower liquidity. This would imply over 30% re-rating potential from current levels and correspond to a valuation of 11.9x on 1YR FWD P/E basis.

* MSCI EFM EUROPE + CIS (E+C) ex Russia index

One of the key prerequisites for this re-rating potential to materialise is a resolution of the Russia–Ukraine war, which, when it occurs, would act as a powerful catalyst for further narrowing of the valuation gap. Recent increase in high-level engagement have shifted market perceptions toward a more plausible path to de-escalation or at least a durable ceasefire. Even without a comprehensive peace agreement, any credible framework that reduces tail risks, clarifies the security outlook, and stabilises regional trade and capital flows would likely be sufficient to trigger a further reassessment of risk premia. In such a scenario, investors who have been structurally avoiding Emerging Europe on geopolitical grounds are likely to return, initially through broad regional exposure and subsequently through more selective positioning, accelerating valuation normalisation across the asset class.

Another material driver of regional equity returns over the coming years is the favourable earnings outlook, underpinned by an improving trend in earnings revisions in recent months. Corporate earnings growth potential in Emerging Europe remains strong and is well supported by the positive macroeconomic backdrop. The expected 3-year forward-looking earnings CAGR for the regional benchmark stands at approximately 13.9%, materially exceeding the 8.7% projected for the MSCI ACWI and 5% for the Euro Stoxx 50. Should this growth materialise, it would represent a powerful and sustained driver of equity returns in Emerging Europe.

The macro outlook for Emerging Europe in 2026 remains constructive, supported by a combination of gradual cyclical recovery, easing financial conditions, and a pick-up in investment activity. Regional GDP growth is expected to approach 3%, led by Poland with expansion of around 3.5%, alongside solid contributions from the rest of the region. The macro backdrop should benefit from further monetary easing, with rate cuts expected in Poland, Hungary, Romania and Turkey, supporting both household consumption and corporate investment. Growth acceleration increasingly hinges on a recovery in investment activity. Poland is expected to lead, with investment growth of around 12% yoy, followed by Greece at approximately 8%, while consumer spending is projected to remain resilient across most markets. Consumer sentiment, in particular, stands out as a relative bright spot compared with the Eurozone and the US, with the exception of Romania, reinforcing expectations of a cyclical recovery. EU funding remains a key structural support for investment, with remaining RRF resources scheduled to be drawn in 2026. At the same time, Germany’s recently announced fiscal stimulus is expected to provide positive spillovers to the region through trade and investment channels.

We continue to bet on Poland and Greece

In terms of portfolio positioning of Avaron Emerging Europe Fund Poland and Greece remain the largest country exposures with 31.6% and 21.3% weights. In Poland we hold a 3.6pp underweight, while in Greece we are 3.8pp overweight. Top-down we find arguments to be invested in both. In Poland, economic growth accelerated in 2025 and is expected to remain around 3.5% in 2026, supported by rising investment, easing inflation and still-solid household consumption – a near-Goldilocks macro setup. Inflation could surprise on the downside, potentially falling below 2.5% in 2026, which would support real wage growth and allow for more than two 25bps rate cuts.

Greece’s economy is also expected to maintain solid growth above 2% in 2026, driven by resilient consumption and investment supported by the EU funds. The services sector, including IT and tourism, remains a key growth engine. Wages are projected to rise by around 4% yoy, underpinned by increases in the minimum wage, reductions in social security contributions, and income tax reforms. Despite these fiscal measures, strong nominal GDP growth and continued budget surpluses are expected to keep the public debt ratio on a downward trajectory, with debt-to-GDP projected to fall below 140% by 2027.

Besides favourable macro backdrop, corporate earnings outlook and valuations in both countries are appealing. Although Polish WIG Index has re-rated back to 10-year historical average level of 12x 1YR FWD P/E, strong expected earnings CAGR of 16% for the next three year should provide attractive return potential. Greek ATHEX Index trades at 10.6x 1YR FWD P/E, 18% discount to 10-year historical average, with expected 3-year earnings CAGR of 8.9%.

Our re-entry to Turkey

During 2025, we re-entered Turkey after being on the sidelines for nearly two years and built the exposure to 11.2%, while remaining 1.4 percentage points underweight versus the benchmark. The decision was driven by a clear regime shift in macroeconomic policy following the 2023 elections and the resulting improvement in the macro outlook. Central bank credibility has been restored through a return to orthodox monetary policy, a renewed focus on price stability, and materially tighter financial conditions, which helped inflation fall to around 30% in 2025 from a peak above 70% in mid-2024. We had deliberately stayed out of the market due to the intentional economic slowdown, the introduction of inflation accounting, and the associated earnings compression, particularly among non-financial companies. That adjustment phase has largely run its course. With inflation continuing to ease, monetary policy has entered a gradual easing cycle, although progress toward the central bank’s 16% end-2026 inflation target remains ongoing. Against this backdrop, the outlook for corporate earnings is improving meaningfully. Banks are positioned for a near-term rebound in profitability as deposit costs normalise, while consumer-oriented and export-driven companies should benefit from recovering domestic demand and currency-linked revenues. In addition, valuations remain highly attractive. The BIST 100 index trades at around 5.1x 1YR FWD P/E, representing a 43% discount to its 10-year historical average, while the implied 3-year earnings CAGR stands at a robust 74% in nominal terms.

Appealing valuation level

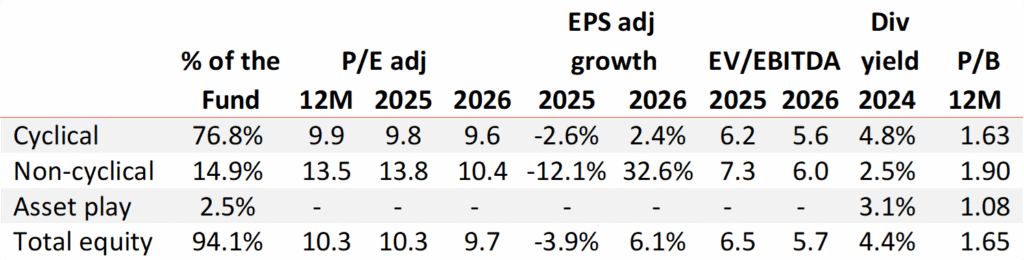

Avaron Emerging Europe Fund portfolio today trades at 9.7x 1YR FWD P/E assuming 8.4% earnings CAGR for the portfolio companies in the next 2 years. The expected ROE for the portfolio companies this year stands at 15.8%, while trailing cash flow yield is 7.7%. Leverage level remains contained with net gearing at 39% and net debt to EBITDA of 1.33x. The portfolio offers strong 4%+ DY at 43% payout rate.