Re-entry to Turkey

Strategic Re-Engagement After a Period of Volatility

We used the late-March volatility in Turkey to add back exposure in 3 companies amounting to 5.0% of the Fund. We exited the market in the beginning of 2023 following the 124% rally in € the previous year.

Post-Election Correction Sets the Stage

After the general and presidential elections in May 2023 that saw the ruling coalition led by the Justice and Development Party (AKP) retain majority in the parliament and incumbent President Erdogan re-elected we witnessed a massive 33% correction in lira against the euro within a 2-month period. However, since the second half of 2023, Turkey has undertaken a sweeping normalization of its macroeconomic policy framework, abandoning the low interest rate approach that had led to hyperinflation. Under the leadership of Finance Minister Mehmet Simsek and CBRT Governor Fatih Karahan, the country has returned to orthodox monetary policy with a clear mandate to restore price stability and rebuild institutional credibility.

Disinflation and Policy Normalization in Focus

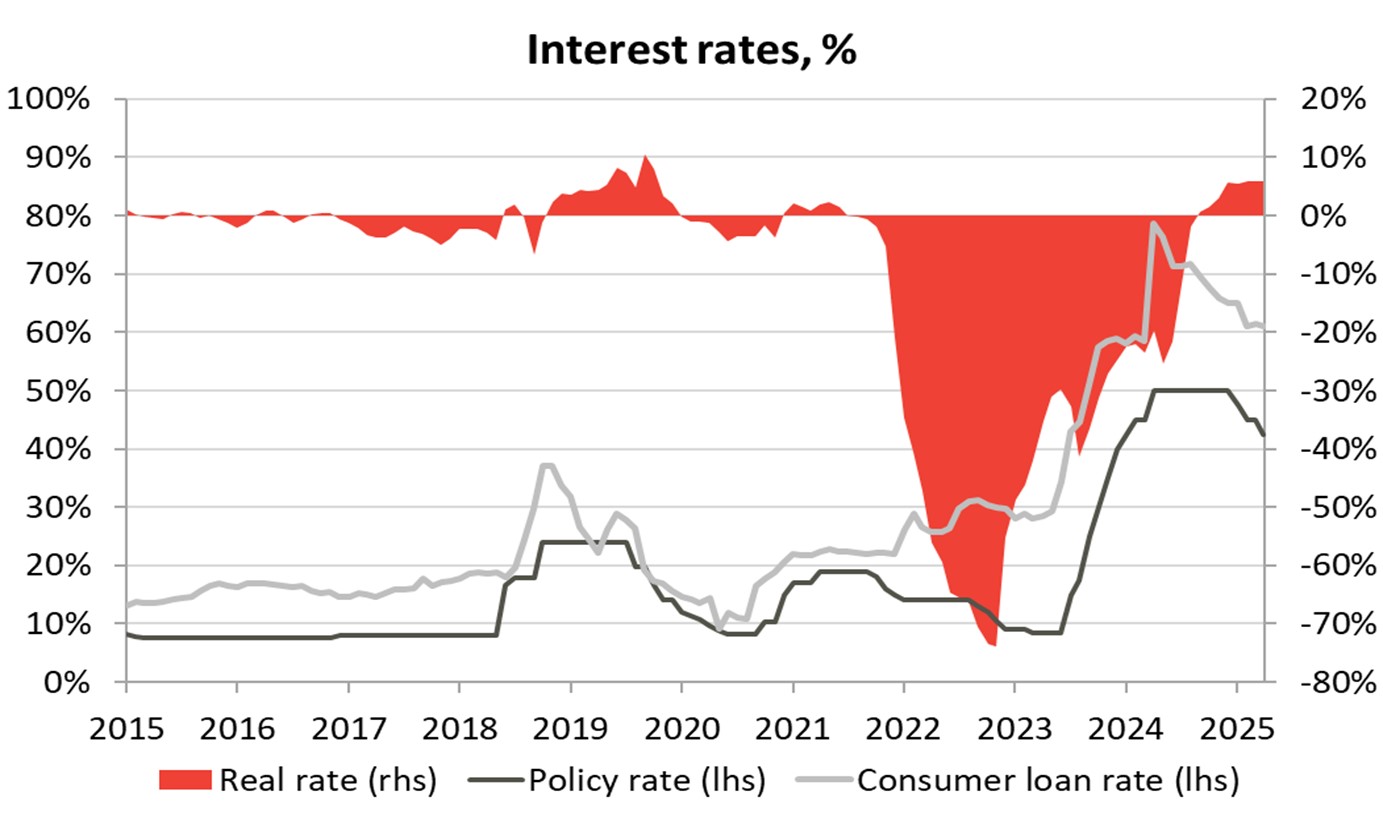

Turkey’s annual inflation rate peaked at approximately 75% in May 2024, driven by years of ultra-loose monetary policy and the 2023 currency shock cycling through. Since then, inflation has moderated significantly due to a sustained central bank tightening cycle that saw the policy rate moving from 8.5% in June 2023 to 50% by April 2024. As of February 2025, inflation has decelerated for nine consecutive months, reaching 39.1% with year-end expectations close to 30%. This disinflationary trend reflects not only the high base effect but also the CBRT’s commitment to its inflation-targeting framework. Forward-looking inflation expectations have begun to anchor more firmly, a critical precondition for real interest rates to remain positive and monetary policy to regain its transmission function. CBRT’s actions during the recent currency volatility episode are in our view commendable as it swiftly drained excess lira liquidity and temporarily tightened lira rates. However, currency stabilization did come at a cost as within four days CBRT’s net reserves declined by $28bn after which the FX market calmed down.

Measured Monetary Easing Amid Stability

Following the tightening cycle that brought the policy rate to 50%, the CBRT began a carefully calibrated easing cycle in December 2024, lowering the benchmark rate by 750bps to 42.5% now. This has been aligned with declining inflation momentum, improving inflation expectations, and correspondingly positive real interest rate buffer. Governor Karahan has reaffirmed that monetary easing will proceed in a data-dependent and measured fashion, and that CBRT remains committed to a tight monetary stance until clear progress is made on inflation stabilization, ensuring credibility is not sacrificed for growth.

Source: CBRT

Reserve Rebuilding and External Confidence

Rebuilding the central bank net reserves has been one of the key successes of the current administrative team. After hitting a low of $15.2bn in March 2024 with swap adjusted net reserves at -$65.1bn(!) the net reserves in mid-March prior the market volatility stood at $73.9bn and on swap adjusted basis at $65.4bn. This recovery has been made possible by a mix of external financing, improved current account dynamics, and tight capital management. While recent FX interventions temporarily reduced reserves, CBRT retains ample liquidity buffers and swap lines to maintain FX stability and deter disorderly depreciation without compromising reserve adequacy.

Macroprudential Tools Reinforce the Policy Mix

In parallel with conventional policy tools, the administration has deployed a broad set of macroprudential regulations to curb excessive credit growth, reduce import-fueled demand, and guide lending toward productive sectors. These include loan growth caps (2% monthly for TL, 1.5% for FX), targeted credit policies with incentives offered to companies that enhance investment, employment, production, exports, or contribute to the current account surplus, and stricter regulatory buffers for banks. These measures are designed to align credit expansion with disinflation goals, discourage speculative borrowing, and support macroeconomic rebalancing.

Growth Trends and Sectoral Implications

The tight monetary policy framework has understandably led to a moderation in growth momentum. After expanding 4.5% in 2023, the economy has entered a period of slowdown, with domestic demand intentionally restrained to bring inflation under control. Growth in 2024 stalled as the economy entered a technical recession in Q2-3. However, Q4 saw a surprising rebound attributed to the turnaround in household consumption, which turned positive on qoq basis after a negative reading in Q3 and accelerating investments despite negative contributions from inventory build-up and net exports. In 2024 the Turkish economy grew 3.2% yoy and current market expectations for 2025 point towards GDP growth between 3-3.5%.

We had been refraining from re-entering Turkey over the past 18 months due to the combination of the expected economic slowdown and its impact on corporate earnings together with the switch to inflation accounting in 2024 that additionally significantly suppressed the earnings. The banking sector was spared from switching to inflation accounting, which has further complicated the situation for investors in assessing the financials. Regardless, the earnings contraction materialized with Turkish blue-chip non-financials posting on average around 30% inflation adjusted yoy earnings contraction and banks ca. 20% non-adjusted contraction. Factoring in 40%+ inflation, the real earnings contraction in the banking sector, hit by unfavorable loan-to-deposit spreads last year, was somewhere around 60%.

2025 Outlook: Positioning for Earnings Recovery

Looking ahead, we anticipate a more supportive backdrop in 2025 as inflation continues to ease. Real incomes begin to recover, and the gradual easing cycle resumes. This environment sets the stage for a constructive earnings recovery across sectors. Banking sector should post strong earnings growth (+82% yoy in nominal terms) on improving margins while consumer demand should improve supporting non-financial companies’ earnings (+74% yoy on inflation adjusted terms). Companies with functional currency in $ or € should post 27% yoy earnings growth. Valuation wise Turkey on index basis looks appealing, especially as the earnings momentum should be positive. The main benchmark index BIST100 trades at 4.5x 1YR FWD P/E, 36% discount to historical 10-year average and 58% discount to MSCI EM.