Trade war implications on Emerging Europe

On February 1, 2025, President Trump issued three executive orders directing the United States to impose new tariffs on imports from Canada, Mexico, and China, to take effect on February 4, 2025. In addition, Trump hinted that the European Union would be next to face tariffs, and it could happen “pretty soon”. These tariffs are part of Trump’s strategy to address trade imbalances, protect domestic industries, and counter perceived unfair trade practices. However, they have significant implications for global trade and economic stability, and according to research conducted on the previous wave of tariffs in 2018-19 unlikely to result in positive desired outcome. For example, researchers found near-complete pass-through of US tariff increases to US domestic prices, implying welfare losses.

When trying to gauge the potential impact of US tariffs on the EU, let’s first look at how the main Emerging Europe economies differ in terms of the trade openness. Small and open economies are more vulnerable to rising trade barriers and rising protectionism. Emerging Europe countries have experienced significant trade expansion in recent years, characterized by increasing trade openness, a growing surplus in services, and deep integration with European and global markets. Over the past two decades we have seen on average around 20-30pp rise across the region in the level of exports and imports to GDP. However, clear differences among countries in terms of trade openness remain.

Source: World Bank

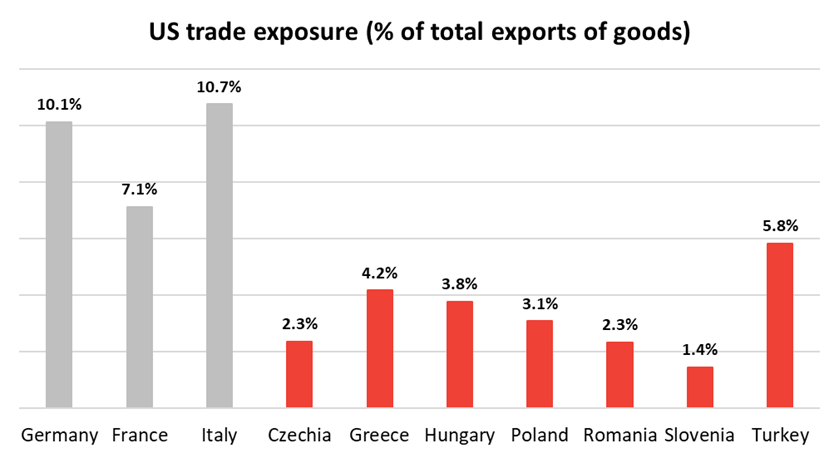

The direct impact on Emerging Europe from US tariffs on the EU is likely to be limited. Looking at our current Avaron Emerging Europe Fund positioning, the 6 main countries that dominate the portfolio with 85.6% combined weight are Czechia, Greece, Hungary, Poland, Romania and Slovenia. Exports to the US accounts 2.9% of their total exports that is significantly lower than in the main Western European economies.

Turkey must be viewed separately here as it is not an EU member state and so far there have been no indications from Trump that he would impose additional tariffs beyond the existing 50% on steel and 20% on aluminium.

Source: UN Comtrade Database

Looking at the trade balance of goods, the US had trade deficit in goods with the EU over $200bn in 2023. Almost all of it can be attributed to Germany, Ireland and Italy. At the same time the trade balances with main Emerging Europe economies were similarly in deficit but significantly smaller in absolute terms. In relation to the overall trade (exports and imports) the trade deficits, or surpluses when looking from the perspective of European countries, Germany-Ireland-Italy had a surplus of 45% of total goods trade while Emerging Europe countries had a surplus of 23%.

Source: UN Comtrade Database

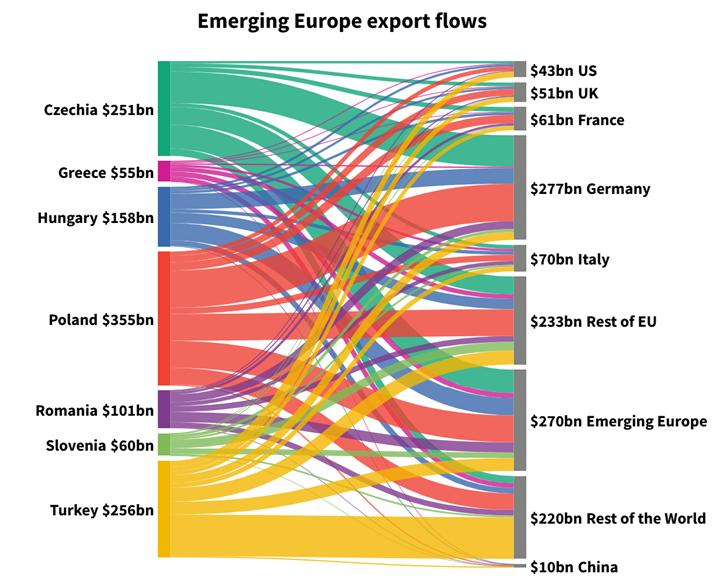

While the mentioned Emerging Europe economies may not have substantial direct trade with the US, their deep integration into Western European supply chains makes them vulnerable to indirect effects. Many regional countries serve as crucial links in the manufacturing networks of Western Europe, especially Germany. For instance, components produced in Poland or Czechia are often exported to Germany for final assembly before being shipped to the US. If the U.S. imposes tariffs on European goods, it could disrupt these supply chains, leading to reduced demand for intermediate goods from Emerging Europe countries.

Economists estimate that a 10% US tariff on European goods could decrease the Eurozone’s GDP by approximately 0.3%. Given the interconnectedness of the EU economy, Emerging Europe countries would likely experience a ripple effect, facing slower growth due to decreased demand from their primary Western European trading partners.

Source: UN Comtrade Database

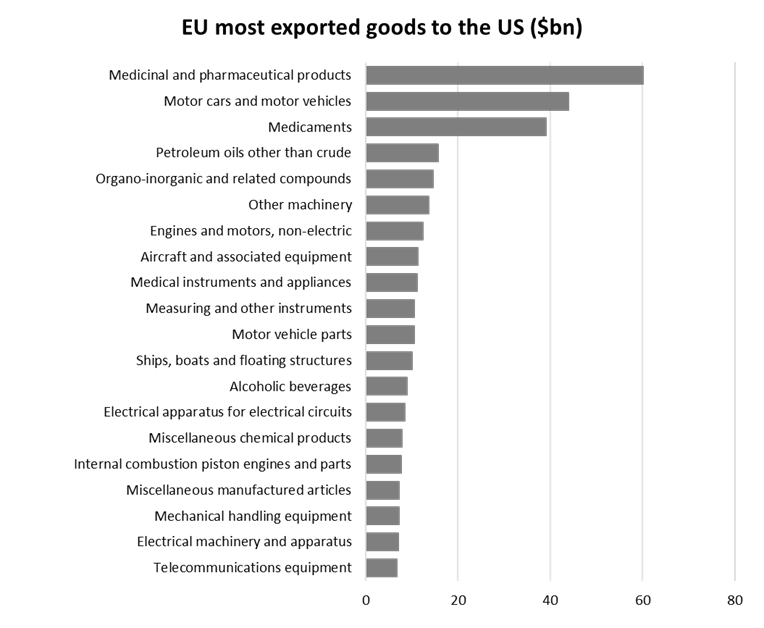

To establish what sectors could be specifically targeted by Trump let’s look at the structure of US imports. It reveals that pharmaceutical and medical products, motor vehicles, refined crude products, and machinery are the main export articles of the EU. In terms of trade balance, the same product groups stand out with the largest surpluses for the EU, making them primary targets to tariffs.

Source: Eurostat

In Emerging Europe certain specialization among countries in terms of prevalent manufacturing sectors exists that gets reflected in main export categories. Motor vehicles, parts and accessories is a segment most vulnerable to potential tariffs and could have the largest impact on several countries as in Czechia, Hungary and Romania these products are the primary export articles, accounting for 16-19% of total exports. In Poland, Slovenia and Turkey these products are among the TOP5 export segments with 10-12% share.

Other important product groups that dominate the exports within these countries are electrical equipment and electronics (11% of exports in the total exports of these 7 countries), food products (10%), metal products (10%) and plastics and rubber (5%). However, there are a few product groups that are especially important or specific to certain countries. For example, pharmaceuticals are the dominant export revenue driver in Slovenia (25% of total exports), and important to Greece (5%) and Hungary (4%) as well. Textiles stand out in Turkey as the 2nd most important export article with 14% share. Greece, having roughly 2x higher refining capacity compared to local demand, exports around 50% of refined petroleum products, mainly to Europe, generating around 30% from this product group.

Looking at Avaron Emerging Europe Fund portfolio, there should be very limited direct impact of US tariffs if any at all. We do not have any direct exposure to the auto industry and only hold one proper industrial company from which revenues 15% is related to metallurgy with no direct exports to the US. One production company and our pharmaceutical companies either have negligible sales to the US or operate via local subsidiaries/licencing agreements and produce in the US locally.